Solar Panel Financing Options in Australia

Exploring Solar Panel Financing Options in Australia: A Practical Guide for Homeowners

Understanding Solar Panel Financing

Overview of Solar Panel Systems

Solar panels are an excellent way for homeowners in Australia to harness renewable energy, reduce electricity bills, and decrease their carbon footprint. A typical solar panel system consists of photovoltaic (PV) cells that convert sunlight into electricity, along with inverters, mounting systems, and sometimes battery storage. As you consider this investment, understanding solar panel financing options is crucial to selecting a solution that fits your budget and energy needs.

The Importance of Financing Options

The Importance of Financing Options Purchasing solar panels outright may not be feasible for everyone; this is where solar panel financing options come into play! Various financing methods make the transition to renewable energy more attainable. Financing not only makes solar panels financially accessible but also allows you to spread the cost over time, giving you immediate access to the benefits of solar energy without the burden of a full upfront payment.

Factors to Consider Before Choosing a Financing Option

Before diving into the specifics of financing, consider these crucial factors:

- Your budget and financial capacity

- Expected energy savings from solar panels

- System size and installation costs

- Your home’s solar potential (roof size, direction, shading)

- State and federal incentives that may apply

These factors will help you determine which financing route aligns best with your personal situation and goals.

Types of Solar Panel Financing Available

Upfront Purchase

Buying solar panels outright is the most straightforward option. You pay for the entire system upfront and enjoy immediate benefits, including:

No monthly payments: Once the system is installed, you won’t have to worry about repayments.

Full ownership: You own the system and can enjoy all benefits, including government incentives and tax credits.

Long-term savings: Although the initial cost is higher, you’ll save more on energy bills over time.

However, this option requires significant capital upfront, which can be a barrier for many.

Solar Loans

Solar energy loans allow you to finance your solar installation over time, similar to a car loan or mortgage. Here’s why they can be a good option:

Lower upfront costs: Pay a portion upfront and borrow the rest.

Flexible terms: Many lenders offer various loan lengths and interest rates suited to your needs.

Tax incentives: You can often still take advantage of government rebates and tax benefits.

Researching interest rates and repayment terms is vital as these vary significantly among lenders.

Solar Leases and Power Purchase Agreements (PPAs)

If upfront purchase or loans sound daunting, leasing your solar panels or entering a PPA could be suitable for you. Here’s how they work:

Solar Leases: Pay a fixed monthly fee to use the panels for a set period, after which you typically have the option to buy the system.

Power Purchase Agreements (PPAs): Agree to buy the power generated by the solar panels at a set price, which can be lower than your current electricity rates.

While these options offer low initial costs, they often result in less overall savings than owning the system.

Government Incentives and Rebates

Australian Government’s Small-Scale Renewable Energy Scheme (SRES)

The Australian government offers incentives through the Small-Scale Renewable Energy Scheme (SRES), allowing homeowners to receive financial benefits when installing solar systems. Under this scheme, homeowners can earn Renewable Energy Certificates (RECs) that can be sold or used to decrease the overall installation cost, effectively lowering your initial investment.

State-Specific Incentives and Programs

In addition to federal incentives, many states offer their own rebates and programs. For instance:

Victorian Solar Homes Program: Provides rebates for eligible solar panel installations.

Queensland Solar Incentive: Offers additional financial incentives in the form of rebates.

Always check your state’s website for current offerings as these can significantly affect your financing options.

Additional Benefits and Tax Benefits Besides government schemes, consider other perks such as:

Increased property value: A solar installation can boost your home’s market value.

Tax benefits: Depending on your financial situation, solar systems might come with certain tax deductions.

Assessing Your Financial Situation

Evaluating Your Energy Savings Potential

Before jumping into financing, evaluate how much you spend on electricity and how much you could save with solar. This will often depend on your energy usage patterns and the size of the system you choose.

Understanding the Total Cost of Ownership

The total cost of ownership goes beyond installation costs. Consider:

– Maintenance and repair costs over time.

– Potential savings on energy bills and any state or federal incentives.

– Resale value of your home in the future.

Taking all these into account will provide a clearer picture of your investment.

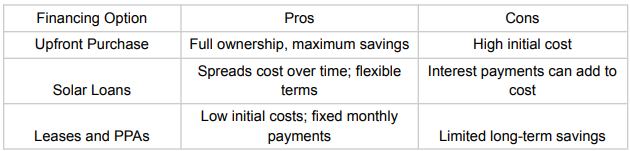

Comparing Financing Options: Pros and Cons

As you consider financing options like solar panel financing, weigh their pros and cons:

Steps to Secure Solar Financing

Researching and Comparing Lenders

Take time to research potential lenders. Look for:

- Reviews from previous customers.

- Interest rates and financing terms.

- Any additional fees associated with loans.

Many comparison websites simplify this process by allowing you to see options side by side.

Preparing Your Application

Once you select a lender, prepare your application by gathering:

- Personal financial information.

- Home details (and any relevant documents).

- Information about the solar system you intend to install.

Having your documents organized can speed up approval.

Finalizing the Agreement and Installation

After securing financing, review final agreements carefully. Ensure you understand all terms before signing. Once everything is set, schedule installation and prepare to enjoy clean energy!

Conclusion

Making an informed decision regarding solar panel financing can lead you towards energy independence. Whether you choose to buy outright, lease, or enter a PPA, weighing your options against your financial situation is crucial. Always explore available government

incentives like green loans in Australia, as they can significantly lessen the financial load associated with transitioning to solar energy.

“Solar energy is not just for the affluent; it’s for anyone ready to embrace a greener future.”

FAQs

What are typical repayment terms for solar loans?

Repayment terms for solar loans usually range from 5 to 20 years depending on the lender and amount financed.

How does a solar lease differ from a solar loan?

A solar lease requires monthly payments for using panels while a solar loan enables purchasing over time with ownership rights.

What should I do if I can’t afford the upfront cost of solar panels?

Explore financing options like solar panel financing, leases, or PPAs. Additionally, check regional and federal incentives that may help reduce costs.